reit dividend tax south africa

Foreign shareholders of SA REITs are levied a dividend withholding post tax at. Alternatively such income may be vested in.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

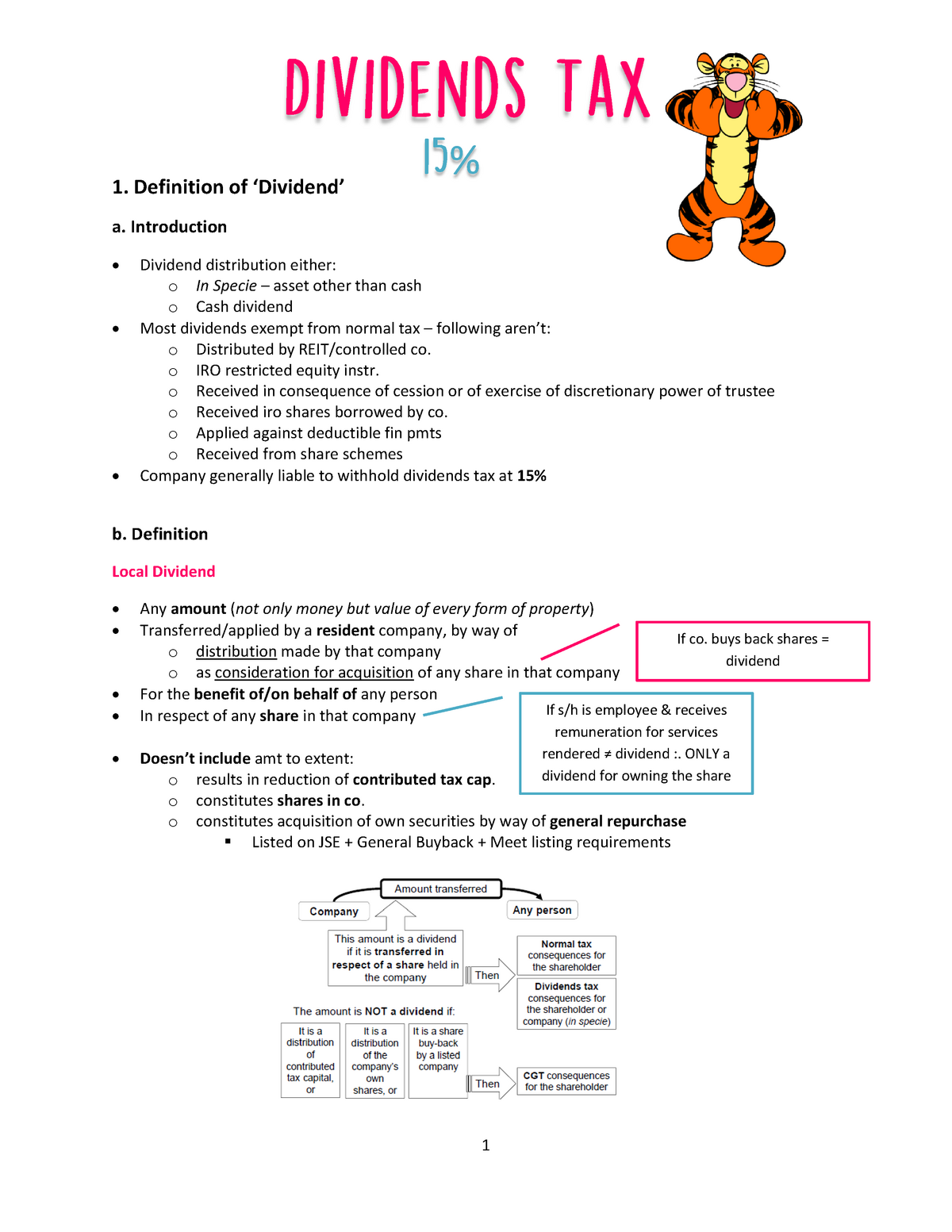

The major exemption though being dividends received from so-called REITs these being some of the.

. Taxation of investors South African resident natural persons A South African tax resident natural person investing in a REIT will be subject to income tax on dividends received by or accrued. In South Africa a. 8 hours agoREIT earnings season was surprisingly strong across nearly all property sectors.

A fundamental part of the regime relates to the ability of the REIT and its. Consequently a South African REIT also needs to comply with the JSE Listings Requirements for REITs which broadly require that it. Dividend tax withheld at 20 Distribution to investors21 Tax on investors taxable incomeLl Net return for the individual investors all REIT RI 00000 RIOOOOO RIOOOOO R45OOO R55OOO.

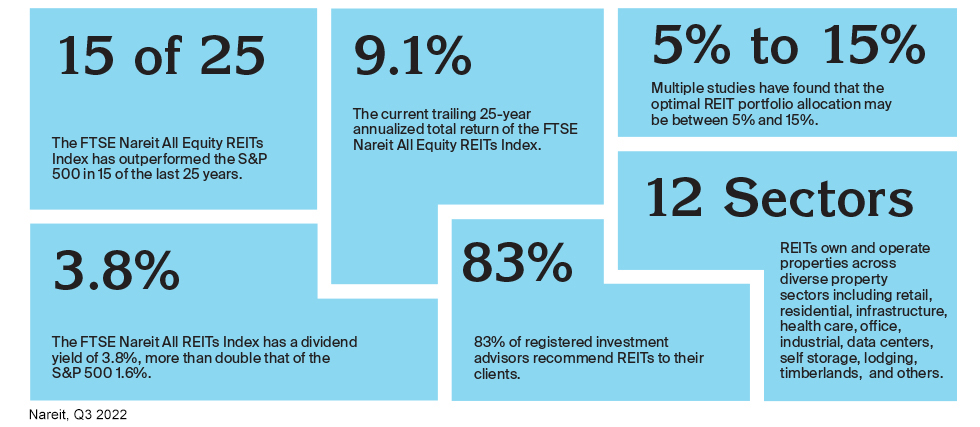

Dividends Tax 23 February 2022 No changes from last year Dividends received by individuals from South African companies are generally exempt from income tax but. Owns at least R300m on of property. Among the 90 REITs that have provided full-year Funds From Operations FFO guidance 58.

1 August 2015 at 1643 Hello I have received a Tax Certificate from my stock broker and it says Total nett REIT dividends. Dividends received by a South African taxpayer are generally exempt from income tax. REIT Dividends received by South African tax residents must be included in their gross income and will not be exempt from income tax in terms of the exclusion to the general.

Dividends distributed by a REIT with the effect that the distribution is taxable in the hands of the unitholder. March 2 2015. A Real Estate Investment Trust REIT is a company that derives income from the ownership trading and development of income producing real estate assets.

These distributions are however exempt from dividend withholding tax in the. A South African trust investing in a REIT would be liable to income tax in respect of dividends received or accrued from a REIT at a rate of 40. The REIT regime in South Africa aims to create a flow though vehicle for income tax purposes.

Section 25BB of the Income Tax Act was adopted in South Africa with effect from 1 April 2013 to govern the taxation of real estate investment trusts REITs. Property owning subsidiaries of REITs also benefit from the section 25BB tax dispensation. Reit Dividends Tax Posted 2 August 2015 Peter says.

Foreign natural persons and trusts. The trust or if relevant the beneficiary of the trust will however be exempt from dividends tax in respect of such dividend. Broadly speaking a qualifying distribution means dividends paid or payable by the REIT or a controlled company or interest incurred in respect of debentures that form part of.

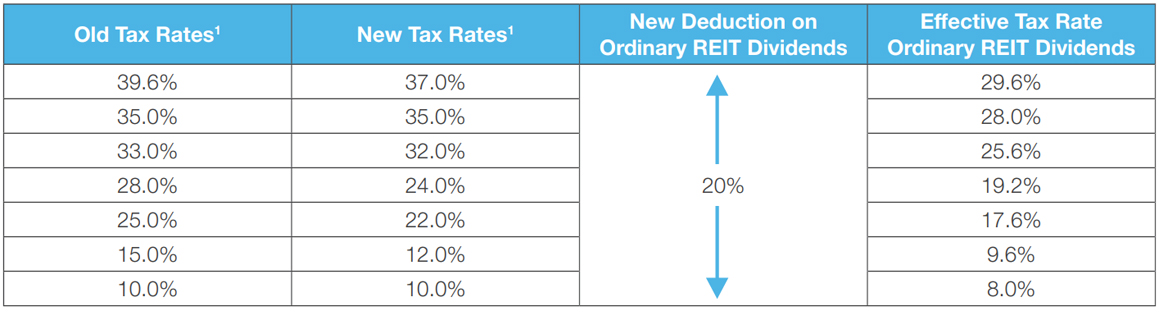

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

Dividends Tax Notes 1 Definition Of Dividend A Introduction Dividend Distribution Either O Studocu

Income Stocks With A Trump Tax Bonus

Emergence Of Real Estate Investment Trust Reit In The Middle East

Here Are The Basic Taxes You Should Know About If You Re Investing Your Money

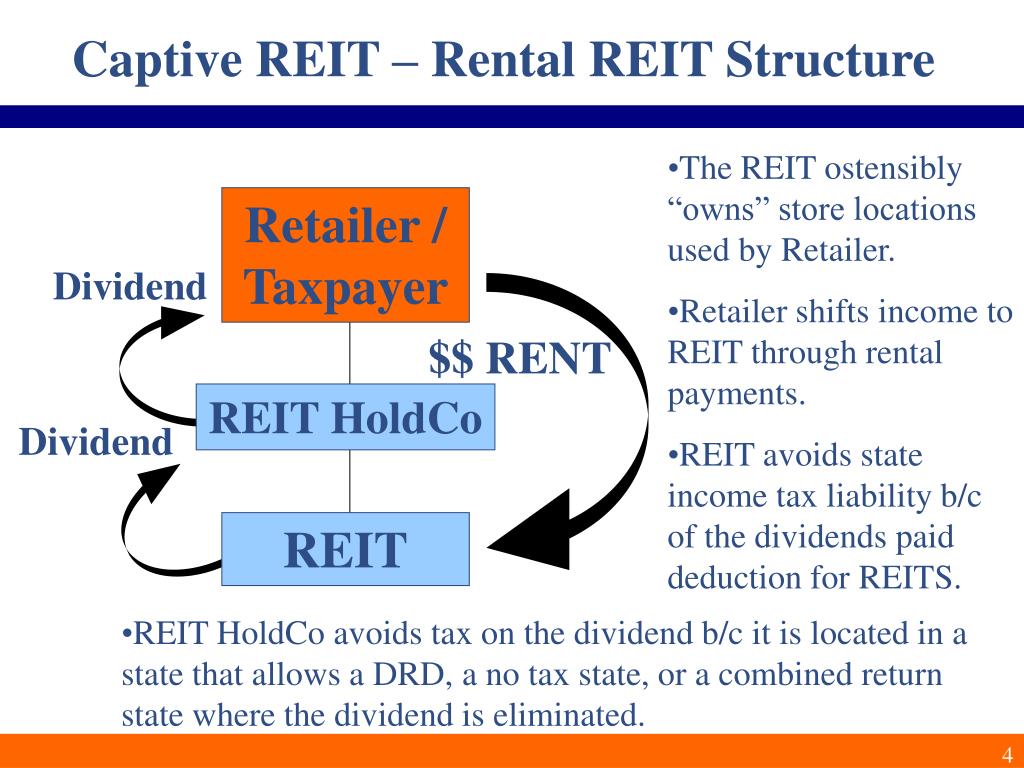

Ppt Captive Reits Powerpoint Presentation Free Download Id 6707728

Doing Business In The United States Federal Tax Issues Pwc

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

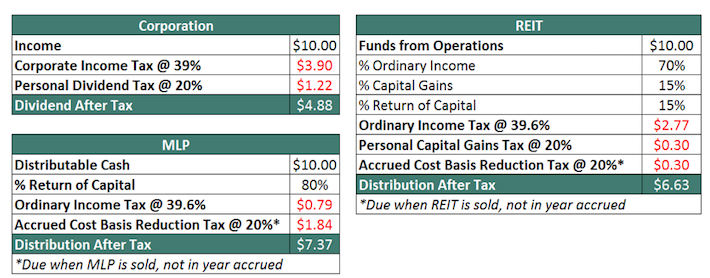

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

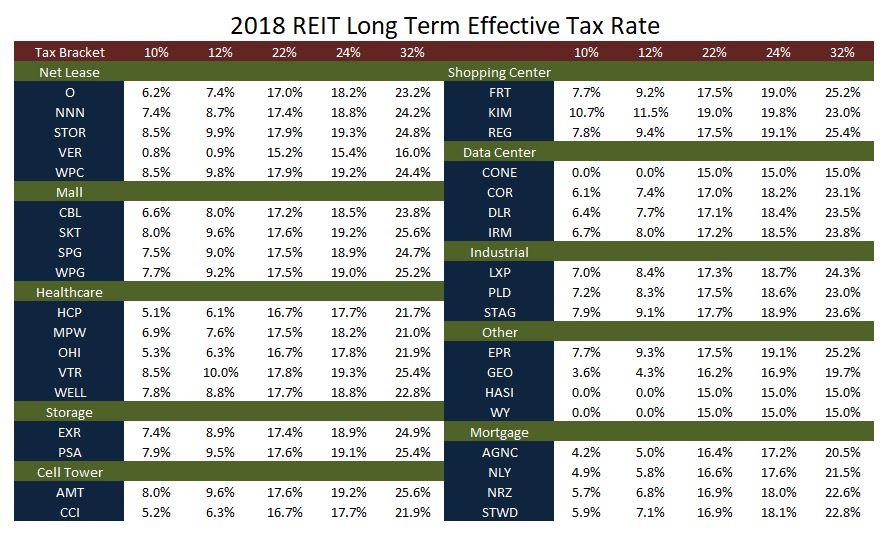

How Tax Efficient Are Your Reits Seeking Alpha

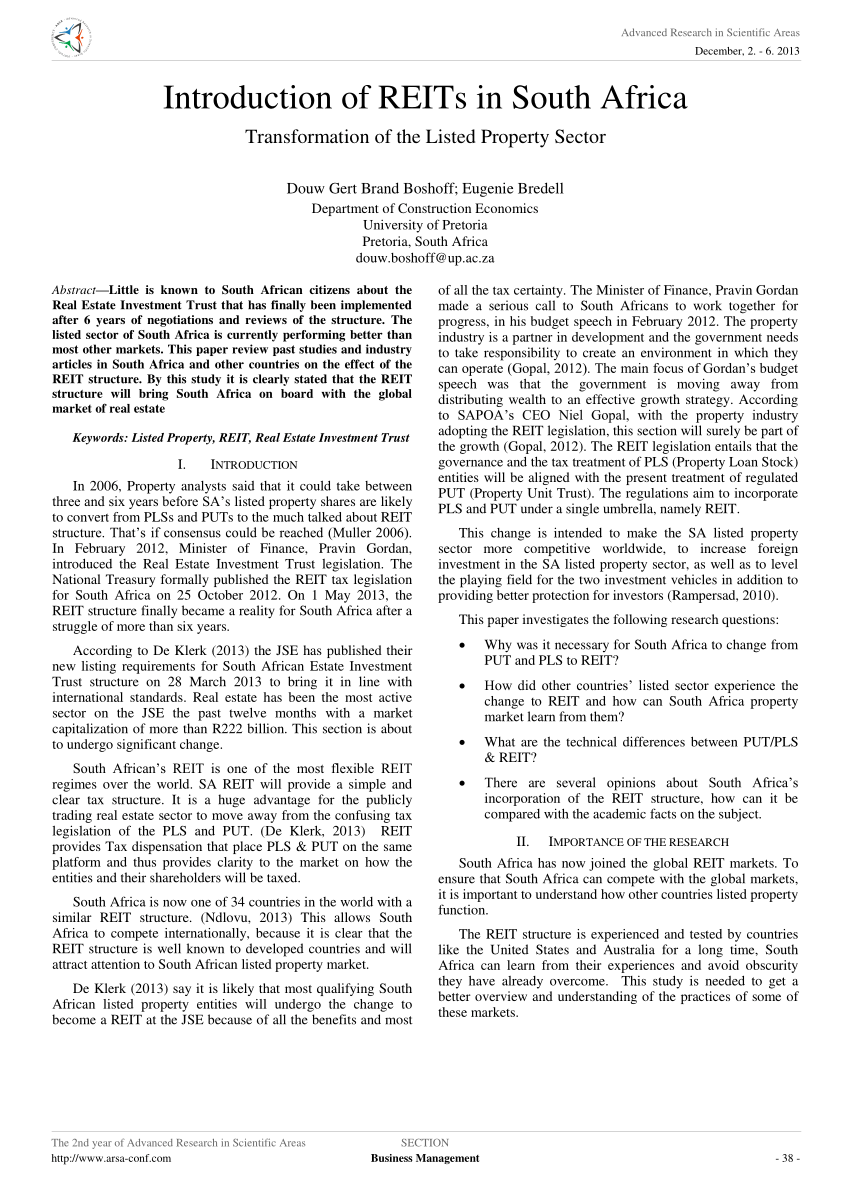

Pdf Introduction Of Reits In South Africa Transformation Of The Listed Property Sector

How To Value Reits In 2022 Real World Examples

Emergence Of Real Estate Investment Trust Reit In The Middle East

Public Reits Vs Private Real Estate Investment Tactica Real Estate Solutions

Understanding How Reits Are Taxed Smartasset

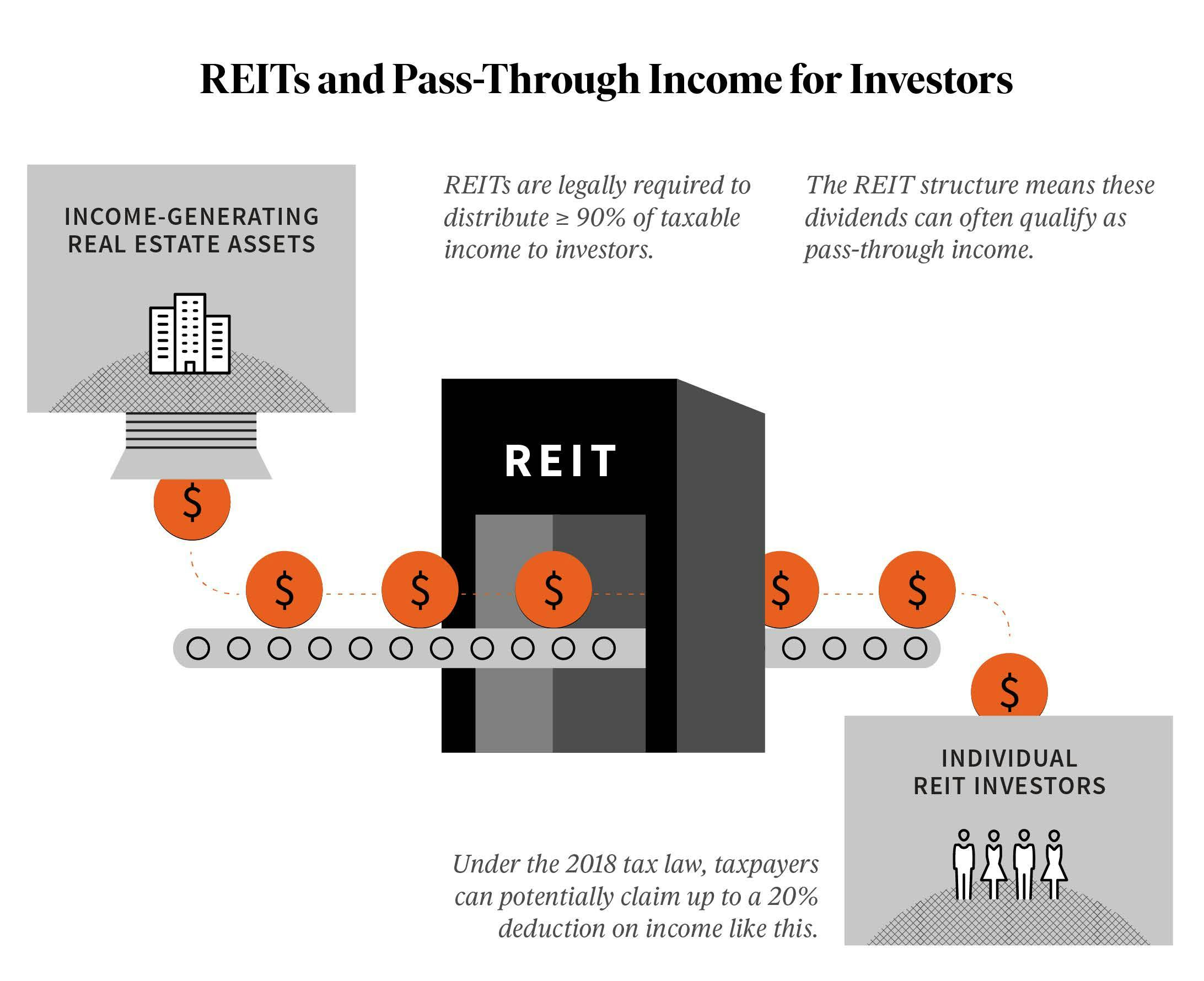

Reits 101 A Beginner S Guide To Real Estate Investment Trusts Fundrise

Don T Forget Taxes When Comparing Dividend Yields Cfa Institute Enterprising Investor