aurora sales tax rate

What is the sales tax rate in Aurora South Dakota. The 8 sales tax rate in Aurora consists of 4 New York state sales tax and 4 Cayuga County sales tax.

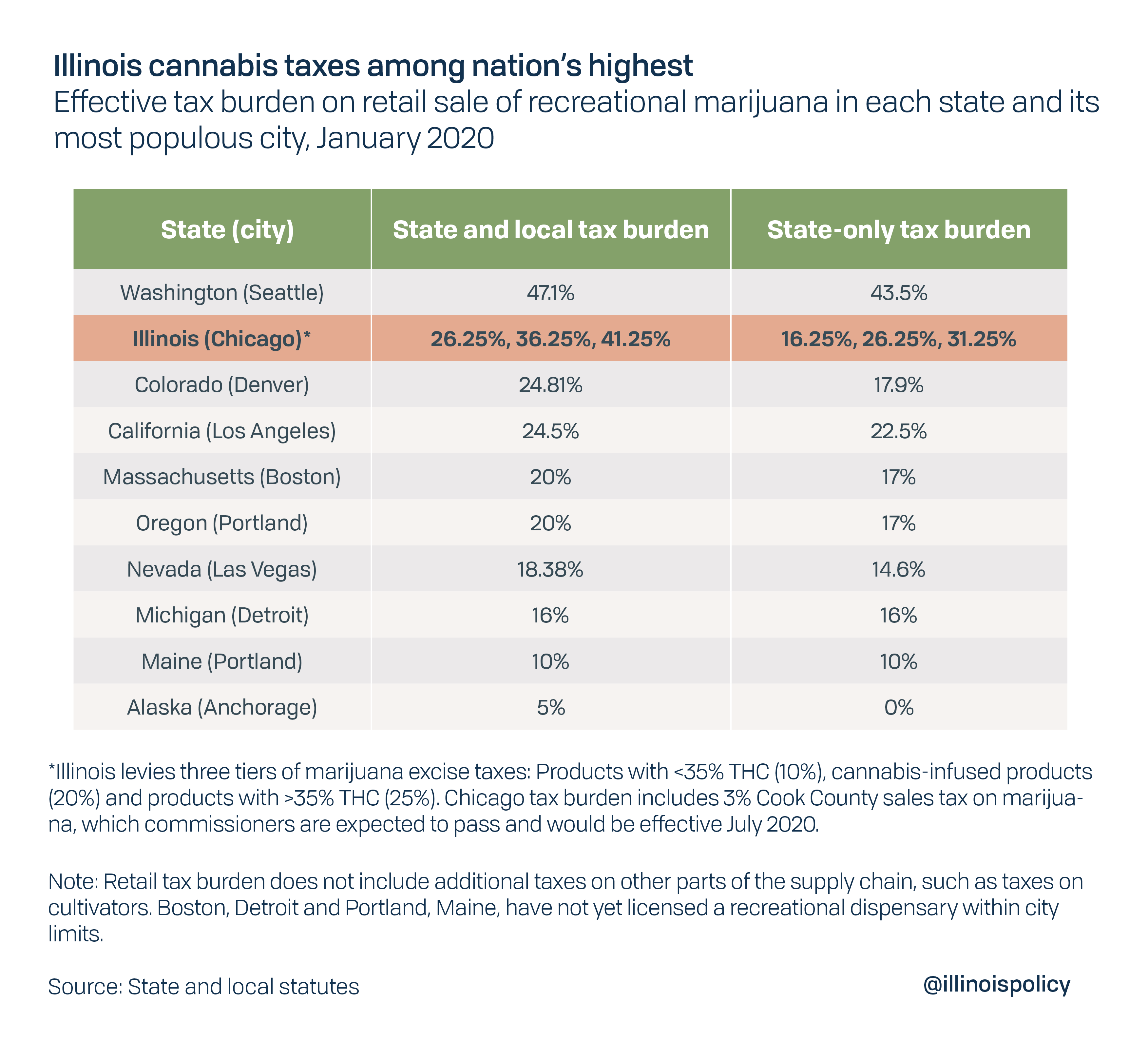

Illinois Cannabis Taxes Among Nation S Highest Could Keep Black Market Thriving

2020 rates included for use while preparing your income tax deduction.

. What is the sales tax rate in Aurora Nebraska. This rate includes any state county city and local sales taxes. The latest sales tax rate for Aurora IL.

Annually if taxable sales are 4800 or less per year if the tax is less than. While Colorado law allows municipalities to collect a local option sales tax of up to 42 Aurora. This rate includes any state county city and local sales taxes.

The 9225 sales tax rate in Aurora consists of 4225 Missouri state sales tax 25 Lawrence County sales tax and 25 Aurora tax. 2020 rates included for use while preparing your income tax deduction. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes.

This rate includes any state county city and local sales taxes. The minimum combined 2022 sales tax rate for Aurora Nebraska is. 2020 rates included for use while preparing your income tax deduction.

The minimum combined 2022 sales tax rate for Aurora Colorado is. Tax and Licensing Calendar. The latest sales tax rate for Aurora SD.

Aurora in Colorado has a tax rate of 8 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora totaling 51. There is no applicable city tax or. What is the sales tax rate in Aurora Colorado.

This rate includes any state county city and local sales taxes. An alternative sales tax rate of 881 applies in the tax region Denver which appertains to zip codes 80010 80012 80014 and 80019. Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month.

This is the total of state county and city sales tax rates. 0875 lower than the maximum sales tax in NY. This is the total of state county and city sales tax rates.

The latest sales tax rate for Aurora MO. There are approximately 213758 people living in the. Special Event Tax Return.

The Aurora Colorado sales tax is 800 consisting of 290 Colorado state sales tax and 510 Aurora local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city. The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax. 0375 lower than the maximum sales tax in MO.

The latest sales tax rate for Aurora CO. 2020 rates included for use while preparing your income tax deduction. The Aurora Utah sales tax is 630 consisting of 470 Utah state sales tax and 160 Aurora local sales taxesThe local sales tax consists of a 150 county sales tax and a 010 city.

The minimum combined 2022 sales tax rate for Aurora South Dakota is. The Aurora Nebraska sales tax is 550 the same as the Nebraska state sales tax. While many other states allow counties and other localities to collect a local option sales tax Nebraska.

The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city. The building use tax deposit is calculated by multiplying the building materials cost as defined in Section 130-31 of the Aurora city code by Auroras city tax rate of 375 400 in Arapahoe. This is the total of state county and city sales tax rates.

The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64. You can find more tax rates and.

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Colorado Aims To Simplify Local Sales Tax Collection For Remote Sellers

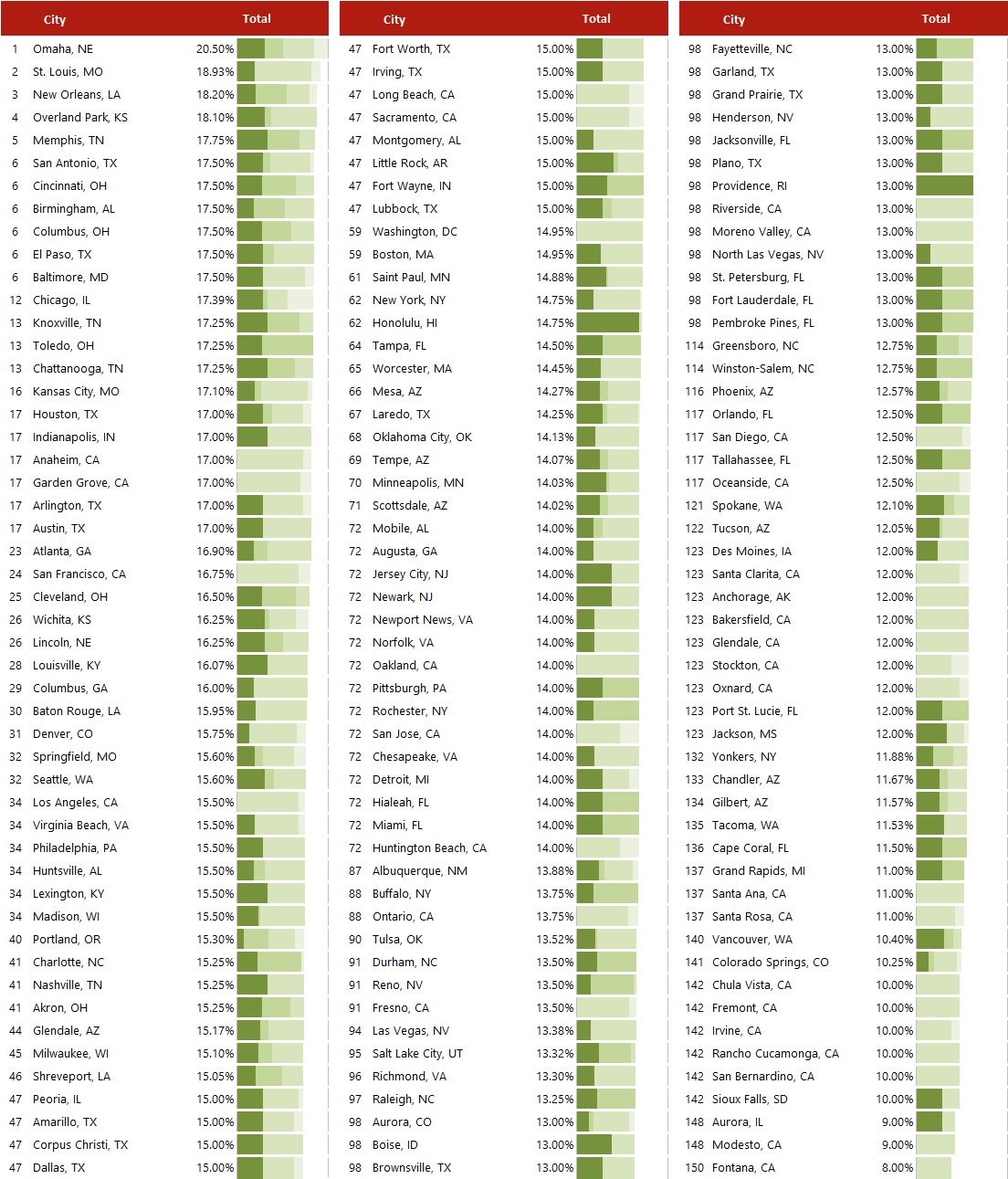

Sales Taxes In The United States Wikipedia

Colorado Homeowners Hit With Sticker Shock Over Property Valuations Have Until End Of May To Protest

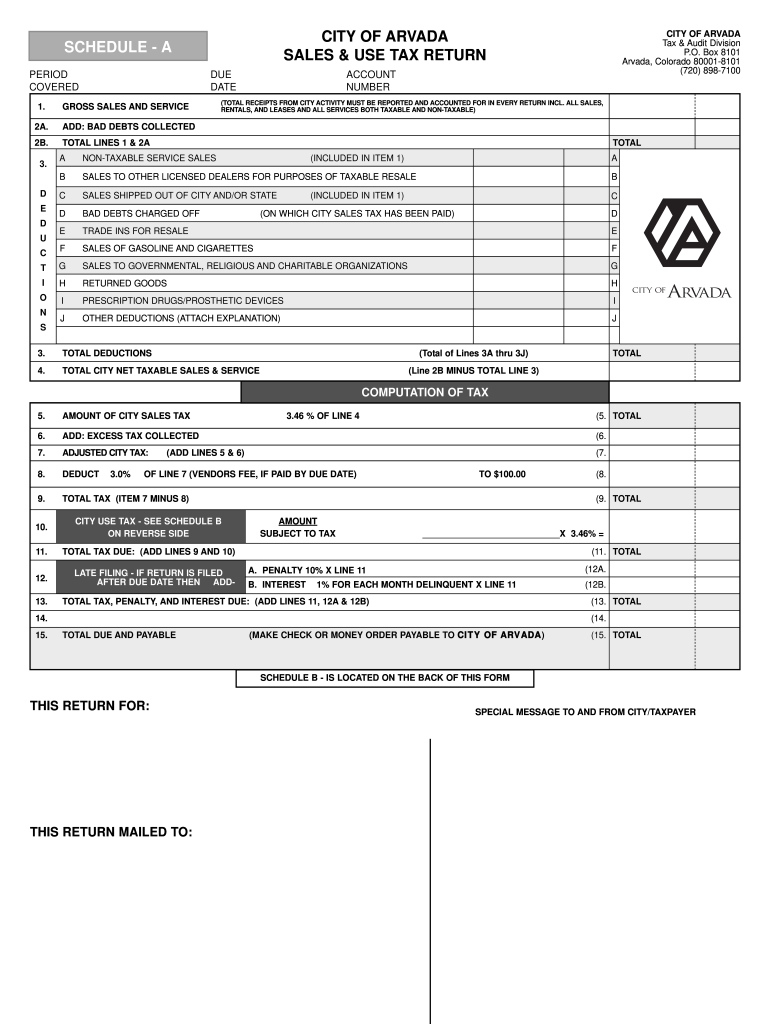

City Of Arvada Sales Tax Fill Out Sign Online Dochub

Hvs 2020 Hvs Lodging Tax Report Usa

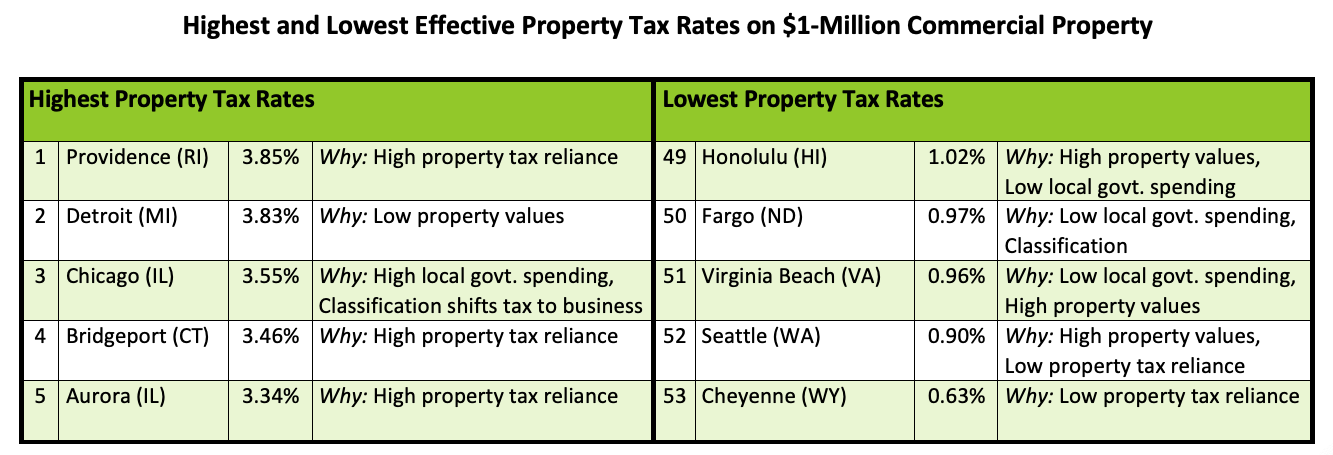

Property Tax Lincoln Institute Of Land Policy

The Lawrence County Missouri Local Sales Tax Rate Is A Minimum Of 6 725

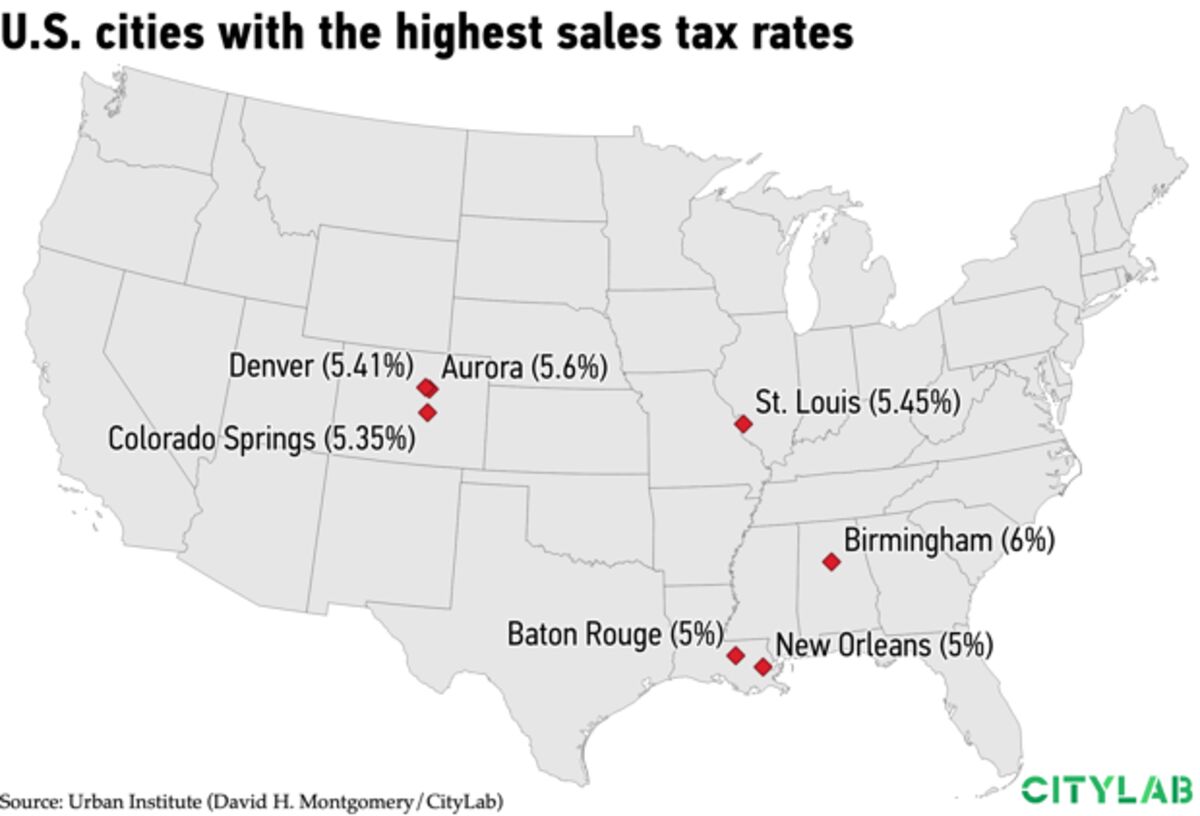

Can Online Sales Taxes Save Main Street Retailers Bloomberg

Colorado Tax Rates Rankings Colorado Tax Rates Tax Foundation

Online Sales Tax Collections Continue To Grow Helped Offset Pandemic Declines Last Year S P Global Ratings